Omicron, Business Transient Return Remain Wild Cards

The calendar year has changed, but many of the same factors weighing on hotel forecasts persist — specifically, the outlook for business transient and group travel, how inflation will play into travel demand, leisure travel’s endurance and the emergence of the COVID-19 omicron variant.

Still, hotel industry prognosticators aren’t pessimistic about performance in 2022, largely thanks to the resilience travelers have shown over the past nearly two years and the power of pent-up demand for travel by people willing to pay pre-pandemic or higher rates.

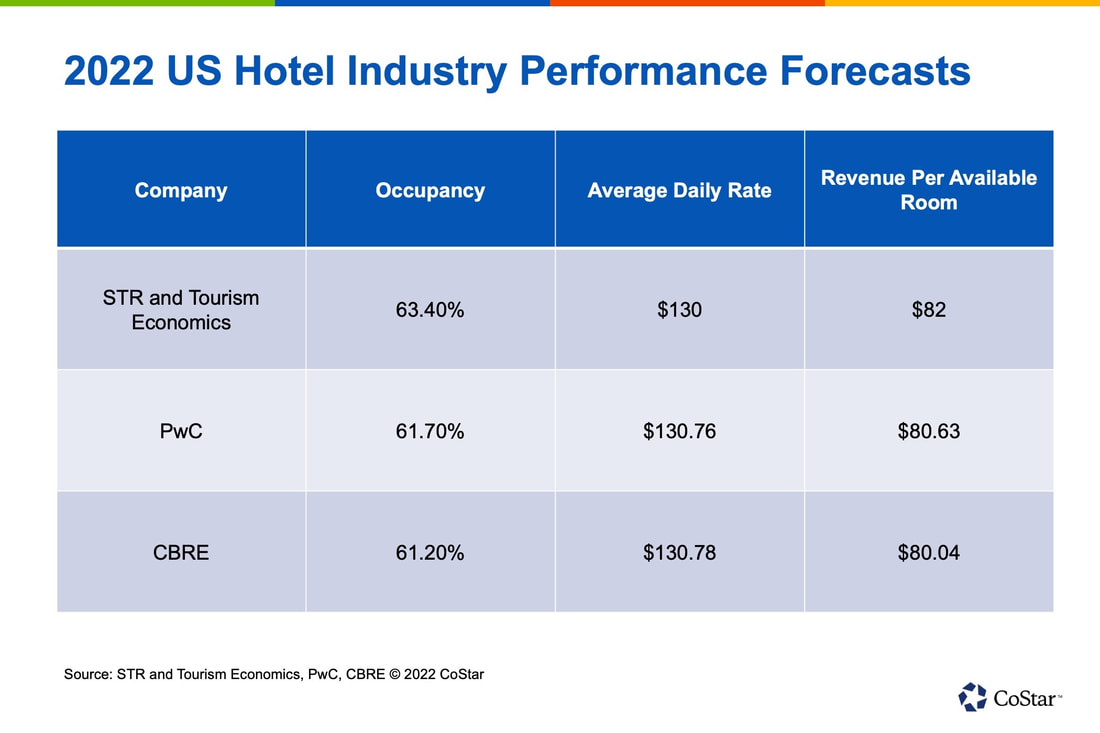

Most of the industry’s largest forecasting firms raised expectations for 2022 performance in the fourth quarter of 2021, citing strong leisure demand, more widespread vaccination and the promising return of some group business on the books.

Still, hotel industry prognosticators aren’t pessimistic about performance in 2022, largely thanks to the resilience travelers have shown over the past nearly two years and the power of pent-up demand for travel by people willing to pay pre-pandemic or higher rates.

Most of the industry’s largest forecasting firms raised expectations for 2022 performance in the fourth quarter of 2021, citing strong leisure demand, more widespread vaccination and the promising return of some group business on the books.

“The summer numbers were better than expected. Forward bookings on group business were short-term positive and even corporate group was turning positive,” said Scott Berman, principal and industry leader of PwC's Hospitality & Leisure Group of his firm’s latest upward revision in November. “The real punchline and lesson learned, and what’s different from any other cycle, is the pricing power. Rate held much better across all the chain scales.”

Blake Reiter, STR's director of custom forecasts, said moving into 2022, he anticipates consumers will be willing and able to spend saved money on travel, despite waves of inflation different parts of the world are experiencing. STR is CoStar’s hospitality analytics firm.

“If we saw this degree of inflation in a normal, non-COVID period, it might restrict travel to some extent,” he said. “But people’s travel savings now are typically much higher than normal, so I tend to think people will continue to travel.”

And while group rates tend to dilute ADR, forecasters haven’t necessarily seen that as too much of a problem as group business picked up in the back half of 2021.

“As group comes back, to some extent hoteliers in some markets at least may sacrifice ADR to get heads in beds to ultimately drive RevPAR, but costs are rising everywhere and hotels still have costs to cover,” Reiter said.

Large events around the world at the end of 2021, like the opening of EXPO 2020 in Dubai and the 2021 Abu Dhabi Grand Prix, gave forecasters further confidence that large-scale events can happen safely, drawing a lot of high-rated demand.

“There’s a lot pushing rates up,” said Natalie Weisz, director of R&D and analysis at STR. “There’s high inflation in many countries, high costs, labor costs going up.”

Kelsey Fenerty, STR analyst, said that while segmentation is still important in driving rates, “it’s not having the impact we expected,” especially in the U.S. "Group rates in the U.S. are up over 2019 levels right now. It’s more the external factors that will keep pushing rates,” she added.

Technology was a silver lining that has supported hoteliers’ abilities to maintain some levels of rate, Berman said.

“The revenue-management tools and technology the industry is investing in is paying off,” he said. “There isn’t a better case study than to look at how rate integrity has been maintained.”

While history indicates people will have no trouble continuing to travel, Tourism Economics' Director of Lodging Economics Aran Ryan said it’s never a given.

“We continue to come back to how consumer spending and consumer travel activity will play out relative to what we had [in 2021],” he said. “Will it be quite as strong? There’s a possibility that some consumers may taper off in their spending activity, and do broader travel volumes take after that?”

Blake Reiter, STR's director of custom forecasts, said moving into 2022, he anticipates consumers will be willing and able to spend saved money on travel, despite waves of inflation different parts of the world are experiencing. STR is CoStar’s hospitality analytics firm.

“If we saw this degree of inflation in a normal, non-COVID period, it might restrict travel to some extent,” he said. “But people’s travel savings now are typically much higher than normal, so I tend to think people will continue to travel.”

And while group rates tend to dilute ADR, forecasters haven’t necessarily seen that as too much of a problem as group business picked up in the back half of 2021.

“As group comes back, to some extent hoteliers in some markets at least may sacrifice ADR to get heads in beds to ultimately drive RevPAR, but costs are rising everywhere and hotels still have costs to cover,” Reiter said.

Large events around the world at the end of 2021, like the opening of EXPO 2020 in Dubai and the 2021 Abu Dhabi Grand Prix, gave forecasters further confidence that large-scale events can happen safely, drawing a lot of high-rated demand.

“There’s a lot pushing rates up,” said Natalie Weisz, director of R&D and analysis at STR. “There’s high inflation in many countries, high costs, labor costs going up.”

Kelsey Fenerty, STR analyst, said that while segmentation is still important in driving rates, “it’s not having the impact we expected,” especially in the U.S. "Group rates in the U.S. are up over 2019 levels right now. It’s more the external factors that will keep pushing rates,” she added.

Technology was a silver lining that has supported hoteliers’ abilities to maintain some levels of rate, Berman said.

“The revenue-management tools and technology the industry is investing in is paying off,” he said. “There isn’t a better case study than to look at how rate integrity has been maintained.”

While history indicates people will have no trouble continuing to travel, Tourism Economics' Director of Lodging Economics Aran Ryan said it’s never a given.

“We continue to come back to how consumer spending and consumer travel activity will play out relative to what we had [in 2021],” he said. “Will it be quite as strong? There’s a possibility that some consumers may taper off in their spending activity, and do broader travel volumes take after that?”

Enter Omicron

The COVID-19 omicron variant could play a role in decreased travel, at least in the short term, potentially throwing a wrench into forecasting.

“Omicron is making headlines and the numbers are staggeringly concerning, but the level of sickness seems right now to be different, so how do you manage that?” Berman asked. “Now the focus is on booster vaccination and creating that safe environment.”

Reiter said STR will continue to analyze its forecast frequently in order to synthesize the best and most recent data.

“Typically in forecasting you’re heavily influenced by seasonality — June of one year tends to behave like June of past years,” he said. “With COVID, we threw that out the window. June was more likely to behave like the preceding month, so forecasts become month to month instead of year over year.”

Weisz predicts that the spread of the omicron variant may delay the return of business transient travel around the world.

“We’ve been basing our forecast on the assumption business travel would come back in a meaningful way in 2022, but now with omicron it might take a bit longer.”

The COVID-19 omicron variant could play a role in decreased travel, at least in the short term, potentially throwing a wrench into forecasting.

“Omicron is making headlines and the numbers are staggeringly concerning, but the level of sickness seems right now to be different, so how do you manage that?” Berman asked. “Now the focus is on booster vaccination and creating that safe environment.”

Reiter said STR will continue to analyze its forecast frequently in order to synthesize the best and most recent data.

“Typically in forecasting you’re heavily influenced by seasonality — June of one year tends to behave like June of past years,” he said. “With COVID, we threw that out the window. June was more likely to behave like the preceding month, so forecasts become month to month instead of year over year.”

Weisz predicts that the spread of the omicron variant may delay the return of business transient travel around the world.

“We’ve been basing our forecast on the assumption business travel would come back in a meaningful way in 2022, but now with omicron it might take a bit longer.”

International Travel

Omicron also is playing into the other wild card for 2022, which is the return of widespread international travel.

While short-haul cross-border travel took place at some levels across Europe and the Asia-Pacific region in 2021, overall international travel trends fluctuated widely and changed often throughout the year.

“We’re watching these international borders closely, especially in the Asia-Pacific,” Fenerty said. “We know domestic will come back, as much and as soon as it can, but international border reopenings are more amorphous.”

Weisz said recent history shows that once markets open back up, hotel performance improves rapidly.

“We expect resilience,” she said. “It won’t be like before when it takes months and months to reopen. We’ve seen markets ramp up really quickly.”

She cited Moscow, which went into a 10-day lockdown in 2021 then ramped back up almost immediately, as an example of how quickly markets can regain business.

Omicron also is playing into the other wild card for 2022, which is the return of widespread international travel.

While short-haul cross-border travel took place at some levels across Europe and the Asia-Pacific region in 2021, overall international travel trends fluctuated widely and changed often throughout the year.

“We’re watching these international borders closely, especially in the Asia-Pacific,” Fenerty said. “We know domestic will come back, as much and as soon as it can, but international border reopenings are more amorphous.”

Weisz said recent history shows that once markets open back up, hotel performance improves rapidly.

“We expect resilience,” she said. “It won’t be like before when it takes months and months to reopen. We’ve seen markets ramp up really quickly.”

She cited Moscow, which went into a 10-day lockdown in 2021 then ramped back up almost immediately, as an example of how quickly markets can regain business.

Other Factors

Labor continues to factor in to hotel performance and forecasts, and 2022 should bring some changes that reflect how much time and attention hoteliers spent on this issue in 2021.

“Consumers continue to pay these high rates and their expectations have to be managed,” Berman said. “The focus will be on managing the labor pool and delivering service for the price achieved.”

“Gradual and controlled are the words I’m using to describe 2022,” he said. “Controlled is about managing occupancies to match the ability to deliver customer service. The temptation is to run at capacity at a high rate but if you can’t deliver, you’ll do more damage to the asset.”

He also predicted the "bleisure" trend of mixing business and leisure travel will drive the business transient recovery in 2022. As companies and business travelers get more comfortable hitting the road, they will take a little extra time for leisure as a reward for the extended months spent at home, off the road, Berman said.

Labor continues to factor in to hotel performance and forecasts, and 2022 should bring some changes that reflect how much time and attention hoteliers spent on this issue in 2021.

“Consumers continue to pay these high rates and their expectations have to be managed,” Berman said. “The focus will be on managing the labor pool and delivering service for the price achieved.”

“Gradual and controlled are the words I’m using to describe 2022,” he said. “Controlled is about managing occupancies to match the ability to deliver customer service. The temptation is to run at capacity at a high rate but if you can’t deliver, you’ll do more damage to the asset.”

He also predicted the "bleisure" trend of mixing business and leisure travel will drive the business transient recovery in 2022. As companies and business travelers get more comfortable hitting the road, they will take a little extra time for leisure as a reward for the extended months spent at home, off the road, Berman said.

Lessons Learned

All the prognosticators agreed that forecasting remains a mix of art and science, though the lessons learned over the past two years will benefit the industry in the future.

“We have learned firsthand how a recovery looks totally different when the cause of it is something other than a traditional economic cause,” Reiter said.

“The root cause of the downturn is going to be heavily linked to the degree and patterns we observe as recovery happens," he said. "It’s a good lesson for forecasters or hotel operators that when events happen that cause a significant drop, we need to understand what caused it and understand human nature and what may lead to a rebound.”

All the prognosticators agreed that forecasting remains a mix of art and science, though the lessons learned over the past two years will benefit the industry in the future.

“We have learned firsthand how a recovery looks totally different when the cause of it is something other than a traditional economic cause,” Reiter said.

“The root cause of the downturn is going to be heavily linked to the degree and patterns we observe as recovery happens," he said. "It’s a good lesson for forecasters or hotel operators that when events happen that cause a significant drop, we need to understand what caused it and understand human nature and what may lead to a rebound.”