I. Market Overview

As housing conditions improve in China, people are becoming increasingly willing to spend money on home decoration. In 2021, per capita disposable income grew 8.1% from the year before. This increased purchasing power has helped the furniture market to expand significantly. The economy has also begun to revive after the Covid-19 pandemic. According to figures from the National Bureau of Statistics, the combined business revenue of furniture manufacturers increased by 13.5% year‑on‑year in 2021 to RMB800.46 billion . However, owing to the rising cost of raw materials and transportation, total profits rose by only 0.9% to RMB43.37 billion.

Data from Huajing Industry Research Institute shows that metal furniture (44.6%) and wooden furniture (33.3%) together account for nearly 80% of the furniture manufactured in China, while soft furniture makes up 7.6%. Despite the Covid-19 pandemic and the sluggish property market, China’s retail sales of furniture still rose by 4.3% in 2021. As noted by China Light Industry Internet, the production of wooden furniture, metal furniture and soft furniture in 2021 increased by 14.1%, 17.7% and 6.1% respectively. According to information from the China National Furniture Association (CNFA) and China National Information Center of Light Industry, total production of furniture in 2021 grew by 14.0% from 2020 to 1.12 billion pieces.

Urbanisation, China’s main policy for stimulating domestic demand, is likely to drive growth in the furniture market. Data from the National Bureau of Statistics shows that the urbanisation rate of permanent residents in China reached 64.7% in 2021, up from 63.87% in 2020. Urban wage earners and peasant families who have settled in towns and cities have become major furniture buyers. According to the Government Work Report 2021, renovation has begun on some 55,600 old residential communities in cities and towns across the country. These communities contain about 9.65 million households and renovating them is likely to drive up demand for furniture significantly.

Mainland furniture consumers can be roughly divided into three groups ‑ avid consumers, luxury and branded goods consumers, and average wage‑earning consumers. They can be characterised in the following way:

As housing conditions improve in China, people are becoming increasingly willing to spend money on home decoration. In 2021, per capita disposable income grew 8.1% from the year before. This increased purchasing power has helped the furniture market to expand significantly. The economy has also begun to revive after the Covid-19 pandemic. According to figures from the National Bureau of Statistics, the combined business revenue of furniture manufacturers increased by 13.5% year‑on‑year in 2021 to RMB800.46 billion . However, owing to the rising cost of raw materials and transportation, total profits rose by only 0.9% to RMB43.37 billion.

Data from Huajing Industry Research Institute shows that metal furniture (44.6%) and wooden furniture (33.3%) together account for nearly 80% of the furniture manufactured in China, while soft furniture makes up 7.6%. Despite the Covid-19 pandemic and the sluggish property market, China’s retail sales of furniture still rose by 4.3% in 2021. As noted by China Light Industry Internet, the production of wooden furniture, metal furniture and soft furniture in 2021 increased by 14.1%, 17.7% and 6.1% respectively. According to information from the China National Furniture Association (CNFA) and China National Information Center of Light Industry, total production of furniture in 2021 grew by 14.0% from 2020 to 1.12 billion pieces.

Urbanisation, China’s main policy for stimulating domestic demand, is likely to drive growth in the furniture market. Data from the National Bureau of Statistics shows that the urbanisation rate of permanent residents in China reached 64.7% in 2021, up from 63.87% in 2020. Urban wage earners and peasant families who have settled in towns and cities have become major furniture buyers. According to the Government Work Report 2021, renovation has begun on some 55,600 old residential communities in cities and towns across the country. These communities contain about 9.65 million households and renovating them is likely to drive up demand for furniture significantly.

Mainland furniture consumers can be roughly divided into three groups ‑ avid consumers, luxury and branded goods consumers, and average wage‑earning consumers. They can be characterised in the following way:

- Avid consumers: this is a very rich group of consumers with little concern for price. They usually favour expensive western style, classical Chinese style or avant-garde furniture.

- Luxury and branded goods consumers: these consumers want furniture to reflect their taste and style. They appreciate aesthetics and cultural elements. They are at the forefront of trends in fashion, lifestyle and price.

- Average wage-earning consumers: this group represents the majority of consumers, who see price and quality as the dominating factors when making purchases. They often shop around before buying.

According to the Industrial Classification for National Economic Activities issued by the National Bureau of Statistics, the furniture industry can be divided according to product type ‑ into wooden, bamboo or rattan, metal, plastic and miscellaneous furniture manufacturing.

A wide range of products is available, in several different categories ‑ furniture for the home, hotel and guest house furniture, office furniture, and public institution furniture:

A wide range of products is available, in several different categories ‑ furniture for the home, hotel and guest house furniture, office furniture, and public institution furniture:

- Home furniture is furniture used in the homes of urban residents, including sofas, TV cabinets, tables and chairs, kitchen furniture and bedroom furniture.

- Hotel and guesthouse furniture is made up of dining tables and chairs, sofas and guest room furniture.

- Office furniture includes items such as desks, chairs, bookshelves and cabinets for use in the office.

- Public institution furniture includes items for use in public sector facilities, such as medical, sports, cultural and educational institutions.

A study by iiMedia Research indicates that consumers have different concerns when buying soft and hard furniture. When buying soft furniture, utility (highlighted as a key concern by 73.2% of consumers), level of comfort (60.3%) and decorative function (55.3%) are the main issues. However, raw materials (67.8%), environmental impacts (60.5%) and the price‑performance ratio (55.9%) are the primary considerations for consumers when purchasing hard furniture. As the national environmental policies of the 14th Five-Year Plan begin to be rolled out, consumers and manufacturers are starting to care more about the environmental friendliness of the materials used, and their effects on health and the environment. They may be concerned, for example, by the formaldehyde content in a particular product.

In 2022, government departments including the Ministry of Industry and Information Technology and the Ministry of Housing and Urban-Rural Development jointly released the Action Plan for Advancing the High-Quality Development of Home Furnishing Industry in a bid to promote collaboration within the industry and enhance its international competitiveness. The following targets were set for 2050: 1) to significantly boost the industry’s innovative capability; 2) to increase the supply of quality products; 3) to accelerate the development of new sectors like smart home furnishing; 4) to establish around 50 well‑known brands and 10 eco‑friendly home furnishing brands; 5) to roll out a batch of quality products; 6) to set up 500 smart home experience centres; 7) to develop 15 high‑level industry clusters with different characteristics; and 8) to stimulate the consumption of high‑quality home furnishing brands.

Given the growing per capita income and rising urbanisation rate, custom‑made furniture has become a bright spot in the industry. According to projections by marketing consultancy Askci, the size of the custom‑made furniture market in 2021 increased by 9% over the previous year, and is expected to hit RMB473 billion in 2022. Custom‑made furniture can be ordered either on a piece‑by‑piece basis or for the whole household. The market can be broken up into different segments, classified according to the materials it’s created from, its function and its style. Custom‑made furniture makes better use of space than ready‑made furniture does, and reduces waste of resources. Currently, consumers of custom‑made furniture mostly buy kitchen cabinets and wardrobes, while other items such as bookcases and shoe cabinets are less popular.

Businesses specialising in custom‑made furniture are now collaborating with property developers to make residential properties more stylish. Such collaborations are already commonplace in first‑ and second‑tier cities, as well as the majority of third‑ and fourth‑tier cities.

Mainland consumers’ demand for outdoor furniture has gradually been increasing too. Outdoor furniture can generally be divided into fixed, movable or portable items. According to data from Statista, retail sales of outdoor furniture in China amounted to US$4.14 billion in 2021 and are expected to top US$7.47 billion in 2026.

Jones Lang LaSalle notes that demand for offices in China reached one of its highest annual levels in 2021, which is likely to mean a rise in the demand for office furniture. Office furniture is mostly made of wood and metal. The production bases are largely centralised around the Pearl River Delta (PRD), the Yangtze River Delta (YRD), the Bohai Bay, and the northeast and the west of China, which together account for 90% of the industry.

Demand for children’s furniture is on the rise. As living standards improve, parents are increasingly willing to buy suitable furniture to create a good environment for their children’s development. With the full implementation of the three‑child policy under the 14th Five-Year Plan (2021-2025), pundits believe that this market has further room for growth. According to the Statistical Communiqué on the 2021 National Economic and Social Development, the number of children in China under 15 reached 263 million in 2021, including 10.62 million newborns. Mainland industry intelligence website Leadleo.com forecasts that the market for children’s furniture could reach RMB182.5 billion by 2024. There are some 1,000 companies across the country producing children’s furniture, the vast majority of them small‑scale operations. When buying children’s furniture, parents’ prime consideration is safety, and most of them prefer to buy from reputable brands. The Standardisation Administration of China (SAC), when issuing a directive on the main points of national standardisation work in 2021 on 6 April 2021, said that it would redouble its efforts to develop national compulsory standards and supportive recommended standards for children’s furniture. These are expected to help improve production quality substantially.

The advances in AI, big data and 5G may see smart household items become mainstream. Many countries are demanding reductions in carbon emissions, and smart homes could go a long way to satisfying user needs in this respect. Smart furniture can use technology to offer better convenience and comfort. Examples of smart furniture include dining tables that can monitor the weight and body temperature of infants, and tables that can adjust their height automatically to match the height of a user. According to figures from data analytics company All View Cloud, 89% of newly completed, furnished apartments are fitted with smart furniture.

In 2022, government departments including the Ministry of Industry and Information Technology and the Ministry of Housing and Urban-Rural Development jointly released the Action Plan for Advancing the High-Quality Development of Home Furnishing Industry in a bid to promote collaboration within the industry and enhance its international competitiveness. The following targets were set for 2050: 1) to significantly boost the industry’s innovative capability; 2) to increase the supply of quality products; 3) to accelerate the development of new sectors like smart home furnishing; 4) to establish around 50 well‑known brands and 10 eco‑friendly home furnishing brands; 5) to roll out a batch of quality products; 6) to set up 500 smart home experience centres; 7) to develop 15 high‑level industry clusters with different characteristics; and 8) to stimulate the consumption of high‑quality home furnishing brands.

Given the growing per capita income and rising urbanisation rate, custom‑made furniture has become a bright spot in the industry. According to projections by marketing consultancy Askci, the size of the custom‑made furniture market in 2021 increased by 9% over the previous year, and is expected to hit RMB473 billion in 2022. Custom‑made furniture can be ordered either on a piece‑by‑piece basis or for the whole household. The market can be broken up into different segments, classified according to the materials it’s created from, its function and its style. Custom‑made furniture makes better use of space than ready‑made furniture does, and reduces waste of resources. Currently, consumers of custom‑made furniture mostly buy kitchen cabinets and wardrobes, while other items such as bookcases and shoe cabinets are less popular.

Businesses specialising in custom‑made furniture are now collaborating with property developers to make residential properties more stylish. Such collaborations are already commonplace in first‑ and second‑tier cities, as well as the majority of third‑ and fourth‑tier cities.

Mainland consumers’ demand for outdoor furniture has gradually been increasing too. Outdoor furniture can generally be divided into fixed, movable or portable items. According to data from Statista, retail sales of outdoor furniture in China amounted to US$4.14 billion in 2021 and are expected to top US$7.47 billion in 2026.

Jones Lang LaSalle notes that demand for offices in China reached one of its highest annual levels in 2021, which is likely to mean a rise in the demand for office furniture. Office furniture is mostly made of wood and metal. The production bases are largely centralised around the Pearl River Delta (PRD), the Yangtze River Delta (YRD), the Bohai Bay, and the northeast and the west of China, which together account for 90% of the industry.

Demand for children’s furniture is on the rise. As living standards improve, parents are increasingly willing to buy suitable furniture to create a good environment for their children’s development. With the full implementation of the three‑child policy under the 14th Five-Year Plan (2021-2025), pundits believe that this market has further room for growth. According to the Statistical Communiqué on the 2021 National Economic and Social Development, the number of children in China under 15 reached 263 million in 2021, including 10.62 million newborns. Mainland industry intelligence website Leadleo.com forecasts that the market for children’s furniture could reach RMB182.5 billion by 2024. There are some 1,000 companies across the country producing children’s furniture, the vast majority of them small‑scale operations. When buying children’s furniture, parents’ prime consideration is safety, and most of them prefer to buy from reputable brands. The Standardisation Administration of China (SAC), when issuing a directive on the main points of national standardisation work in 2021 on 6 April 2021, said that it would redouble its efforts to develop national compulsory standards and supportive recommended standards for children’s furniture. These are expected to help improve production quality substantially.

The advances in AI, big data and 5G may see smart household items become mainstream. Many countries are demanding reductions in carbon emissions, and smart homes could go a long way to satisfying user needs in this respect. Smart furniture can use technology to offer better convenience and comfort. Examples of smart furniture include dining tables that can monitor the weight and body temperature of infants, and tables that can adjust their height automatically to match the height of a user. According to figures from data analytics company All View Cloud, 89% of newly completed, furnished apartments are fitted with smart furniture.

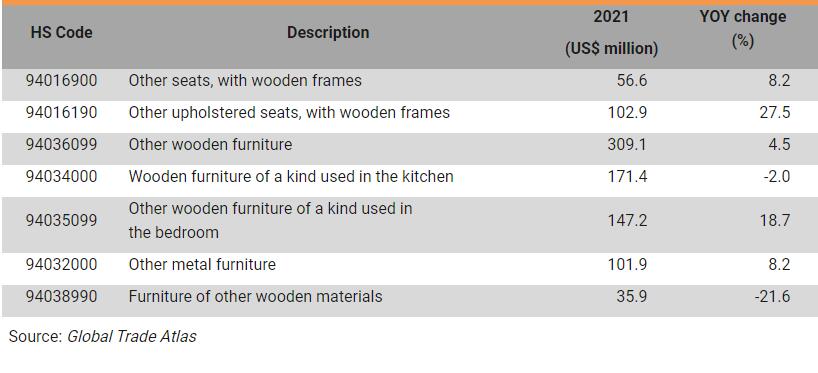

China’s imports of selected furniture products in 2021:

II. Market Competition

After more than 20 years of rapid growth in the Chinese furniture industry, China has now become the world’s largest furniture producer and exporter. According to the CNFA, there are 46 furniture manufacturing clusters in China. Zhejiang is China’s largest furniture manufacturing base with the highest industry concentration, the highest production output and the strongest integrated support capability. Next come Fujian, Jiangsu, Shandong and Shanghai, which have an edge in product quality and operations management. In the YRD, especially in Shanghai, the furniture industry is developing rapidly and boasts the highest average growth rate in the country. The northern and northeastern regions, with Beijing at the centre, have a sound furniture industry base and rich wood resources. In the central and western regions, the furniture industry is actively capitalising on opportunities arising from urbanisation.

China’s smart furniture industry is increasingly mature, and industrial parks for smart household appliances are its main development mode. There are about 115 such industrial parks countrywide, the majority of which are concentrated in Henan, followed by Guangdong, Jiangsu and Tianjin. Furniture and home furnishings industrial parks are mainly found in eight central and western provinces ‑ Jiangsu, Anhui, Henan, Hebei, Hubei, Sichuan, Yunnan and Shaanxi. The development of these industrial parks is helping to consolidate and improve the industry chain, shorten the distance between manufacturing and marketing, reduce logistics costs, change the employment distribution pattern, and promote industrial restructuring, specialised division and industrial co‑operation between the regions. Rising production costs and other market factors may encourage furniture makers to consider shifting inland to the central and western regions, as well as to other Southeast Asian countries.

After more than 20 years of rapid growth in the Chinese furniture industry, China has now become the world’s largest furniture producer and exporter. According to the CNFA, there are 46 furniture manufacturing clusters in China. Zhejiang is China’s largest furniture manufacturing base with the highest industry concentration, the highest production output and the strongest integrated support capability. Next come Fujian, Jiangsu, Shandong and Shanghai, which have an edge in product quality and operations management. In the YRD, especially in Shanghai, the furniture industry is developing rapidly and boasts the highest average growth rate in the country. The northern and northeastern regions, with Beijing at the centre, have a sound furniture industry base and rich wood resources. In the central and western regions, the furniture industry is actively capitalising on opportunities arising from urbanisation.

China’s smart furniture industry is increasingly mature, and industrial parks for smart household appliances are its main development mode. There are about 115 such industrial parks countrywide, the majority of which are concentrated in Henan, followed by Guangdong, Jiangsu and Tianjin. Furniture and home furnishings industrial parks are mainly found in eight central and western provinces ‑ Jiangsu, Anhui, Henan, Hebei, Hubei, Sichuan, Yunnan and Shaanxi. The development of these industrial parks is helping to consolidate and improve the industry chain, shorten the distance between manufacturing and marketing, reduce logistics costs, change the employment distribution pattern, and promote industrial restructuring, specialised division and industrial co‑operation between the regions. Rising production costs and other market factors may encourage furniture makers to consider shifting inland to the central and western regions, as well as to other Southeast Asian countries.

Selected specialised regional production bases in China

With high‑end custom‑made furniture now becoming fashionable, both major brands and small companies are scrambling to enter this blue‑ocean market. Copycat activities are rife, with large numbers of suppliers touting their products as being “identical to [well‑known brand]”. Because of this, businesses need to identify their own position in the market and attempt to beat the competition with superior product materials, design and services. Some companies which used to engage exclusively in furniture sales are now offering home design services to encourage customers to buy furniture for their entire home. Many are adopting a modular approach to product design in order to allow easy mix and match. They also provide home renovation services. The provision of extra services invariably attracts more customers, and as a result this has already become the new normal in the industry.

There is much less concentration of the furniture industry in China than there is in other countries, and most Chinese furniture producers are small or medium‑sized. Data from the Forward Industry Research Institute shows that industry leaders make up less than 3% of the market. According to a report on China’s furniture industry compiled in 2021 by the CNFA, there are now 6,647 furniture enterprises above a designated size in China. With China’s domestic manufacturers only being able to meet the needs of tier‑one cities at the moment, the market is likely to see the entrance of many overseas businesses in the next three to five years, many of them focusing on the high‑end furniture segment. The main sales category for most overseas furniture brands is expected to be soft furniture, such as beds, foam mattresses and knitted fabrics. Other furniture items produced by these brands, such as wardrobes and dining tables, are then likely to enter the Chinese market and compete with domestic brands.

Mainland furniture products are becoming less competitive in the global market, largely because of rising design fees and labour costs. However, China’s domestic market is growing. Rapid urbanisation has spurred the growth of home marts in second‑ and third‑tier cities, where the market offers more room for development. As a result, Chinese furniture producers are likely to make expansion in the domestic market a key marketing strategy.

China's furniture industry has begun the process of upgrading, with advanced manufacturing and the application of information technology in production. Furniture businesses need to upgrade their products and create greater added value by innovating to reduce cost, improve product quality and achieve high efficiency. Developing green manufacturing is likely to become a key future strategy, with the whole life cycle of furniture products managed to protect the environment and reduce energy consumption. Greater attention to environmental protection, health, and safety in the production process should help sustain the development of the furniture industry.

There is much less concentration of the furniture industry in China than there is in other countries, and most Chinese furniture producers are small or medium‑sized. Data from the Forward Industry Research Institute shows that industry leaders make up less than 3% of the market. According to a report on China’s furniture industry compiled in 2021 by the CNFA, there are now 6,647 furniture enterprises above a designated size in China. With China’s domestic manufacturers only being able to meet the needs of tier‑one cities at the moment, the market is likely to see the entrance of many overseas businesses in the next three to five years, many of them focusing on the high‑end furniture segment. The main sales category for most overseas furniture brands is expected to be soft furniture, such as beds, foam mattresses and knitted fabrics. Other furniture items produced by these brands, such as wardrobes and dining tables, are then likely to enter the Chinese market and compete with domestic brands.

Mainland furniture products are becoming less competitive in the global market, largely because of rising design fees and labour costs. However, China’s domestic market is growing. Rapid urbanisation has spurred the growth of home marts in second‑ and third‑tier cities, where the market offers more room for development. As a result, Chinese furniture producers are likely to make expansion in the domestic market a key marketing strategy.

China's furniture industry has begun the process of upgrading, with advanced manufacturing and the application of information technology in production. Furniture businesses need to upgrade their products and create greater added value by innovating to reduce cost, improve product quality and achieve high efficiency. Developing green manufacturing is likely to become a key future strategy, with the whole life cycle of furniture products managed to protect the environment and reduce energy consumption. Greater attention to environmental protection, health, and safety in the production process should help sustain the development of the furniture industry.

III. Sales Channels

Traditional furniture enterprises mainly market their products in three ways: consignment through distributors, renting premises and selling the products themselves, or displaying and selling products through large furniture malls and marts. Some specialised stores and chain stores with financial clout have emerged. The rapid development of the internet and the growth in e‑commerce has meant that online shopping is also becoming an increasingly popular sales channel.

In recent years, furniture hypermarkets have been developing rapidly. Their business scope has been extended to cover areas like interior design and decoration, renovation and on‑site testing and repair, which allows them to provide a one‑stop service to consumers. Many of these hypermarkets have developed across China as single‑brand chain operations. There are also hypermarket clusters – i.e. concentrations of furniture hypermarkets within the same region ‑ as well as general merchandise stores, which sell not only furniture but also other household supplies and building materials. Many chain hypermarkets are also general merchandise stores.

Different types of sales channels focus on different sectors of the market. For instance, large furniture marts mainly offer home furniture but also sell office furniture. Specialised stores generally sell their own brand, with the majority of these stores being large domestic producers or famous foreign brands (such as IKEA from Sweden, the first foreign brand to set up specialised stores on the mainland). This sales format is often adopted by foreign furniture companies.

In recent years, in order to make buying furniture a regular part of consumers’ everyday lives, some branded mart chains have created ‘shopping districts’ by bringing in famous foreign brands, setting up home experience stores, building commercial complexes and establishing furniture villages. This has successfully enabled them to raise brand awareness and increase sales.

The O2O e‑commerce model is gaining popularity in China’s furniture market. O2O refers to the linking of online sales and marketing with offline business operations and consumption. Qumei is a typical example of a furniture manufacturing enterprise and e‑commerce operator. The company uses its website as its sales platform, showcasing products and accepting online orders. Consumers can also visit dealers’ stores and place orders there at online prices. This model allows cost‑effective sales and marketing and drives rapid product sales, speeding up cash flow and reducing inventory pressure.

Some traditional furniture sellers have introduced a different type of e‑commerce. Easyhome, for example, has developed a website which allows it to move its offline experience stores online. It targets consumers who like the brand but want to select products online. Some O2O e‑commerce operators start as pure online brands and open offline experience stores afterwards. In other words, they build up their e‑commerce platform by extending their coverage from online to offline channels. Meilele.com is one example of this. Selling furniture products through physical stores and marts requires a great deal of storage space. Selling them online can overcome this problem by using digital logistics networks. It’s also possible to offer consumers 360‑degree virtual tours through the use of increasingly mature VR technology, which provides them with a new type of shopping experience.

Traditional furniture enterprises mainly market their products in three ways: consignment through distributors, renting premises and selling the products themselves, or displaying and selling products through large furniture malls and marts. Some specialised stores and chain stores with financial clout have emerged. The rapid development of the internet and the growth in e‑commerce has meant that online shopping is also becoming an increasingly popular sales channel.

In recent years, furniture hypermarkets have been developing rapidly. Their business scope has been extended to cover areas like interior design and decoration, renovation and on‑site testing and repair, which allows them to provide a one‑stop service to consumers. Many of these hypermarkets have developed across China as single‑brand chain operations. There are also hypermarket clusters – i.e. concentrations of furniture hypermarkets within the same region ‑ as well as general merchandise stores, which sell not only furniture but also other household supplies and building materials. Many chain hypermarkets are also general merchandise stores.

Different types of sales channels focus on different sectors of the market. For instance, large furniture marts mainly offer home furniture but also sell office furniture. Specialised stores generally sell their own brand, with the majority of these stores being large domestic producers or famous foreign brands (such as IKEA from Sweden, the first foreign brand to set up specialised stores on the mainland). This sales format is often adopted by foreign furniture companies.

In recent years, in order to make buying furniture a regular part of consumers’ everyday lives, some branded mart chains have created ‘shopping districts’ by bringing in famous foreign brands, setting up home experience stores, building commercial complexes and establishing furniture villages. This has successfully enabled them to raise brand awareness and increase sales.

The O2O e‑commerce model is gaining popularity in China’s furniture market. O2O refers to the linking of online sales and marketing with offline business operations and consumption. Qumei is a typical example of a furniture manufacturing enterprise and e‑commerce operator. The company uses its website as its sales platform, showcasing products and accepting online orders. Consumers can also visit dealers’ stores and place orders there at online prices. This model allows cost‑effective sales and marketing and drives rapid product sales, speeding up cash flow and reducing inventory pressure.

Some traditional furniture sellers have introduced a different type of e‑commerce. Easyhome, for example, has developed a website which allows it to move its offline experience stores online. It targets consumers who like the brand but want to select products online. Some O2O e‑commerce operators start as pure online brands and open offline experience stores afterwards. In other words, they build up their e‑commerce platform by extending their coverage from online to offline channels. Meilele.com is one example of this. Selling furniture products through physical stores and marts requires a great deal of storage space. Selling them online can overcome this problem by using digital logistics networks. It’s also possible to offer consumers 360‑degree virtual tours through the use of increasingly mature VR technology, which provides them with a new type of shopping experience.

Selected furniture exhibitions to be held in China in 2022-23:

IV. Import and Trade Regulations

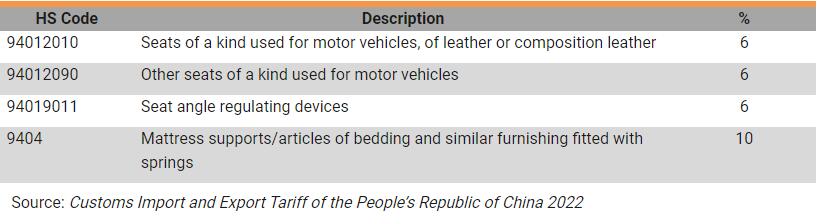

After China joined the WTO, tariffs on furniture dropped significantly. Apart from the products listed below, which are still subject to import duties, a zero tariff has been applied to all furniture items since 2005.

After China joined the WTO, tariffs on furniture dropped significantly. Apart from the products listed below, which are still subject to import duties, a zero tariff has been applied to all furniture items since 2005.

China’s Import Tariff Rates on Furniture in 2022

Foreign companies looking to target the mainland market should study the relevant product standards regulations. Under the Standardisation Law of the People’s Republic of China (2017 Revision), there are five categories of standards ‑ national standards, sector standards, local standards, association standards and enterprise standards. National standards are also divided into mandatory standards and recommended standards, denoted by the letters GB and GB/T respectively. Sector standards are recommended standards and are denoted by QB and QB/T. Local standards are also recommended standards, while enterprise standards are ones that are applied within the business. For a catalogue of the relevant standards, please refer to www.standardcn.com and the website of the Standardisation Administration of China.

The Assessment Indicator System of Cleaner Production—Wood Furniture Manufacturing (GB/T 37648‑2019) and the Requirements for After-sales Service of Furniture (GB/T 37652‑2019) came into effect on 1 January 2020. The former specifies the index system, assessment method, index explanations and data collection for the assessment of clean production in furniture manufacturing. The latter lays down the scope, definitions and service requirements of after‑sales services for furniture.

The General Technical Requirements for Rattan Furniture (GB/T 38466‑2020) and the Technical Specification of Modified Wood for Furniture (GB/T 38467‑2020) both came into force on 1 October 2020. These stipulate the definition, classification, inspection methods, and inspection rules as well as the labelling, use instructions, packaging and shipment of rattan furniture and modified wood.

On 24 November 2020, the SAC issued guidance on the adoption of international standards by national standards (2020 edition), in order to speed up conversions between Chinese standards and international standards. This document covers the standards regulations for furniture.

Chemical Safety in Furniture—Determination of Formaldehyde Emission (GB/T 38794‑2020) and Determination of Emission Rate of Volatile Organic Compounds from Wooden Furniture—Concentration History Method (GB/T 38723‑2020) both came into effect on 1 January 2021. The former specifies the analysis method for the determination of formaldehyde emission from wood furniture. The latter stipulates the concentration history method for determining the emission rate of formaldehyde, benzene, toluene, xylene and total volatile organic chemicals (TVOC) from wooden furniture.

The Technical Specification for Green-design Product Assessment—Application of Phosphating Free Sheet and Strip of Furniture (YB/T 4870‑2020) has been in force since 1 April 2021. It specifies the terminology, definitions, evaluation principles and methods, evaluation requirements and the method of compilation of evaluation reports for life cycles related to the application of phosphating‑free sheet and strip in the green design of furniture.

Furniture Industry Terminology (GB/T 28202‑2020) came into force on 1 July 2021 to replace GB/T 28202‑2011. The names of certain types of furniture, ingredients in materials for making furniture and harmful substances have been added, deleted and revised.

Furniture Harmful Substances—Test Method for Radioactivity (GB/T 38724‑2020) was implemented on 1 November 2021. This regulation stipulates the method for the determination of radioactive substances in furniture, and provides the terminology, principles, instruments, samples, testing procedures, data treatment and uncertainty of measurements in the determination.

The General Administration of Customs began implementing Imported Furniture Inspection Regulations Part 1: General Furniture (SN/T 2419.1‑2021) and Imported Furniture Inspection Regulations Part 2: Children’s Furniture (SN/T 2419.2‑2021) on 1 January 2022 to replace SN/T 2419.1‑2016 and SN/T 2419.2‑2015 respectively. In the part on general furniture, sampling requirements and inspection methods on imported furniture have been added. In the part on children’s furniture, content related to exports and part of the content on conformity assessment activities have been cancelled.

On 1 November 2022, Test Methods for Safety Performance of Children’s High Chairs (GB/T 22793‑2022) will replace the old standard of Furniture Children’s High Chairs Part 2: Test Methods. ISO 9221‑2: 2015 on testing and assessment has been added to regulate further the production, design, sales and testing of children’s furniture. This should help furniture enterprises to improve the versatility and safety of their products.

The new standard, Furniture – Beds – Testing Methods for the Determination of Stability, Strength and Durability (GB/T 41650‑2022) will take effect on 1 February 2023. It covers the testing methods for bed surfaces and frames. ISO 19833: 2018 on testing will be used.

The Assessment Indicator System of Cleaner Production—Wood Furniture Manufacturing (GB/T 37648‑2019) and the Requirements for After-sales Service of Furniture (GB/T 37652‑2019) came into effect on 1 January 2020. The former specifies the index system, assessment method, index explanations and data collection for the assessment of clean production in furniture manufacturing. The latter lays down the scope, definitions and service requirements of after‑sales services for furniture.

The General Technical Requirements for Rattan Furniture (GB/T 38466‑2020) and the Technical Specification of Modified Wood for Furniture (GB/T 38467‑2020) both came into force on 1 October 2020. These stipulate the definition, classification, inspection methods, and inspection rules as well as the labelling, use instructions, packaging and shipment of rattan furniture and modified wood.

On 24 November 2020, the SAC issued guidance on the adoption of international standards by national standards (2020 edition), in order to speed up conversions between Chinese standards and international standards. This document covers the standards regulations for furniture.

Chemical Safety in Furniture—Determination of Formaldehyde Emission (GB/T 38794‑2020) and Determination of Emission Rate of Volatile Organic Compounds from Wooden Furniture—Concentration History Method (GB/T 38723‑2020) both came into effect on 1 January 2021. The former specifies the analysis method for the determination of formaldehyde emission from wood furniture. The latter stipulates the concentration history method for determining the emission rate of formaldehyde, benzene, toluene, xylene and total volatile organic chemicals (TVOC) from wooden furniture.

The Technical Specification for Green-design Product Assessment—Application of Phosphating Free Sheet and Strip of Furniture (YB/T 4870‑2020) has been in force since 1 April 2021. It specifies the terminology, definitions, evaluation principles and methods, evaluation requirements and the method of compilation of evaluation reports for life cycles related to the application of phosphating‑free sheet and strip in the green design of furniture.

Furniture Industry Terminology (GB/T 28202‑2020) came into force on 1 July 2021 to replace GB/T 28202‑2011. The names of certain types of furniture, ingredients in materials for making furniture and harmful substances have been added, deleted and revised.

Furniture Harmful Substances—Test Method for Radioactivity (GB/T 38724‑2020) was implemented on 1 November 2021. This regulation stipulates the method for the determination of radioactive substances in furniture, and provides the terminology, principles, instruments, samples, testing procedures, data treatment and uncertainty of measurements in the determination.

The General Administration of Customs began implementing Imported Furniture Inspection Regulations Part 1: General Furniture (SN/T 2419.1‑2021) and Imported Furniture Inspection Regulations Part 2: Children’s Furniture (SN/T 2419.2‑2021) on 1 January 2022 to replace SN/T 2419.1‑2016 and SN/T 2419.2‑2015 respectively. In the part on general furniture, sampling requirements and inspection methods on imported furniture have been added. In the part on children’s furniture, content related to exports and part of the content on conformity assessment activities have been cancelled.

On 1 November 2022, Test Methods for Safety Performance of Children’s High Chairs (GB/T 22793‑2022) will replace the old standard of Furniture Children’s High Chairs Part 2: Test Methods. ISO 9221‑2: 2015 on testing and assessment has been added to regulate further the production, design, sales and testing of children’s furniture. This should help furniture enterprises to improve the versatility and safety of their products.

The new standard, Furniture – Beds – Testing Methods for the Determination of Stability, Strength and Durability (GB/T 41650‑2022) will take effect on 1 February 2023. It covers the testing methods for bed surfaces and frames. ISO 19833: 2018 on testing will be used.