Forward Bookings Drop in Other Parts of the World

Preliminary performance data from CoStar hospitality analytics firm STR shows no impact from the emerging COVID-19 omicron variant on U.S. hotel demand, and patterns suggest any impact in the future will be minimal, according to Jan Freitag, national director for hospitality analytics at CoStar.

"If preliminary news holds and the strain is more contagious but less impactful for people who have received their booster shot, then we expect little impact on the U.S. travel industry," he said in his latest video analysis of the monthly hotel data.

"If we learned one thing from the summers of 2020 and 2021, it is that the American leisure consumer loves hitting the road, no matter the COVID case counts. This was clearly seen in the Thanksgiving data this year which, according to STR, was the single strongest Thanksgiving week ever recorded," he added.

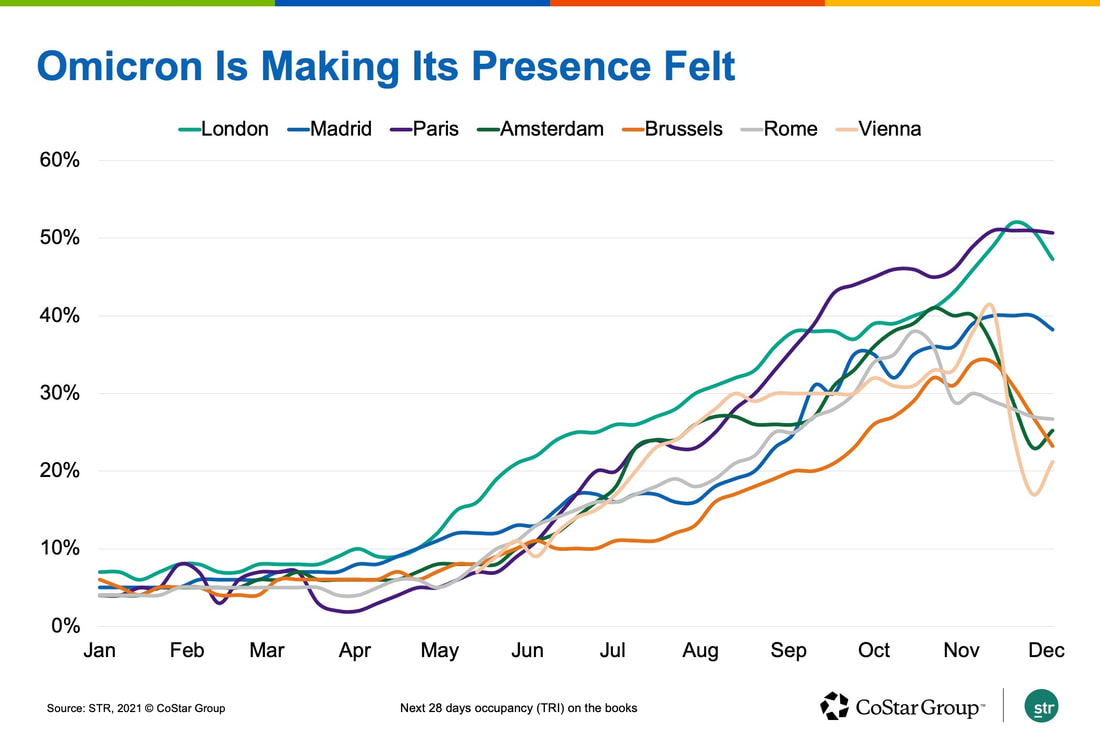

The same cannot be said for other parts of the world, Freitag said. Hotel bookings over the next 28 days are trending down in international markets such as London, Rome, Vienna, Amsterdam, Paris and Madrid.

"If preliminary news holds and the strain is more contagious but less impactful for people who have received their booster shot, then we expect little impact on the U.S. travel industry," he said in his latest video analysis of the monthly hotel data.

"If we learned one thing from the summers of 2020 and 2021, it is that the American leisure consumer loves hitting the road, no matter the COVID case counts. This was clearly seen in the Thanksgiving data this year which, according to STR, was the single strongest Thanksgiving week ever recorded," he added.

The same cannot be said for other parts of the world, Freitag said. Hotel bookings over the next 28 days are trending down in international markets such as London, Rome, Vienna, Amsterdam, Paris and Madrid.

In the U.S., hotel revenue per available room has been trending upward, and in preliminary November data was only 5% below pre-pandemic 2019 levels.

That's good news for the U.S. hotel industry recovery, but revenues are not rising as fast as expenses, particularly for labor, Freitag said.

STR's latest report on U.S. hotel profit and loss margins shows that gross operating profits trail 2019 figures, with the widest gap in the full-service hotel sector. In 2019, GOP made up 40.9% of hotel revenues, compared to 38% in 2021.

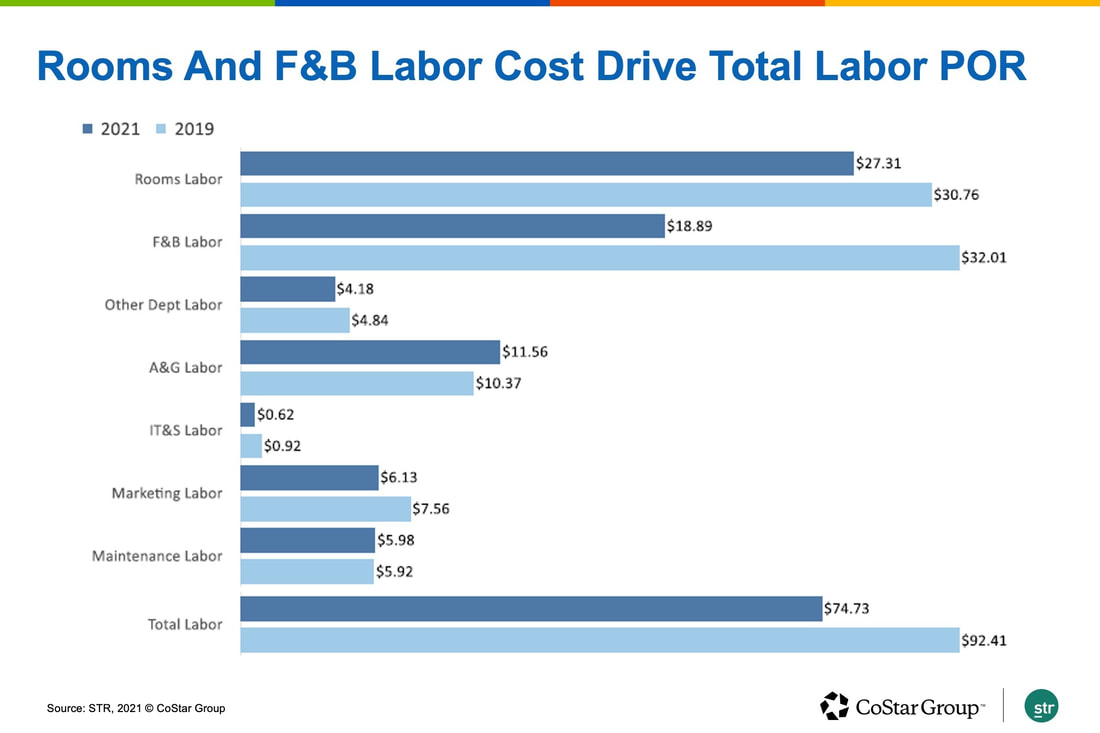

Labor costs per operating room are still below what they were in 2019, and labor costs as a percentage of revenues have normalized, but as hotel demand ramps up and hotels restaff, new hires are demanding higher wages.

That's good news for the U.S. hotel industry recovery, but revenues are not rising as fast as expenses, particularly for labor, Freitag said.

STR's latest report on U.S. hotel profit and loss margins shows that gross operating profits trail 2019 figures, with the widest gap in the full-service hotel sector. In 2019, GOP made up 40.9% of hotel revenues, compared to 38% in 2021.

Labor costs per operating room are still below what they were in 2019, and labor costs as a percentage of revenues have normalized, but as hotel demand ramps up and hotels restaff, new hires are demanding higher wages.

"Overall labor cost as a percent of revenue is basically back where it was two years ago. But it's probably fair to assume that that is just a temporary state, and that the labor cost percentage will increase in 2022," Freitag said.

"Breaking out the labor cost per occupied room shows clearly the sharp increases in rooms labor and [food-and-beverage] labor. That is certainly top of mind for operators and something they had to contend with throughout the year. Not only is it hard to find and retain staff, but the people who are willing to join the hospitality industry demand higher wages."

For more of Freitag's insights on the preliminary November U.S. hotel performance data, watch the video above.

"Breaking out the labor cost per occupied room shows clearly the sharp increases in rooms labor and [food-and-beverage] labor. That is certainly top of mind for operators and something they had to contend with throughout the year. Not only is it hard to find and retain staff, but the people who are willing to join the hospitality industry demand higher wages."

For more of Freitag's insights on the preliminary November U.S. hotel performance data, watch the video above.