How the US Hotel Recovery Appears Different Than Past Cycles

Pre-Inflation, US Hotel Rates Are Keeping Pace With Demand

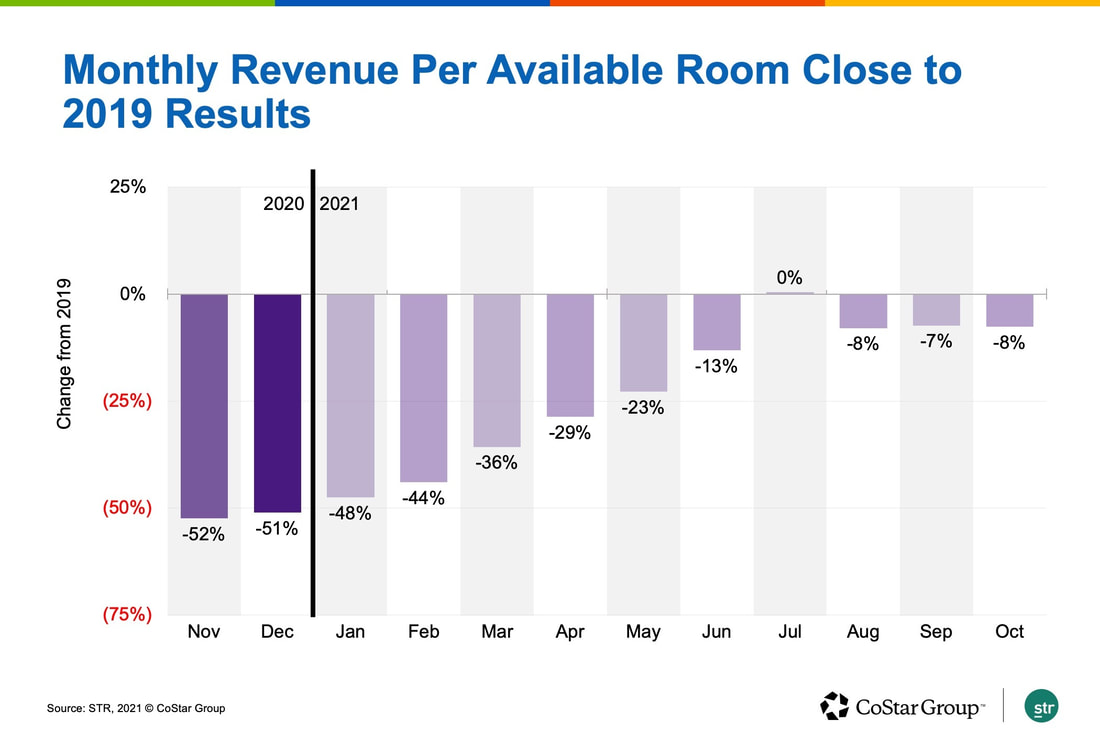

While U.S. hotel performance continues to lag 2019 levels, the rate of recovery is a positive sign for hoteliers industrywide.

According to the latest monthly data from STR — CoStar Group's hospitality analytics firm — U.S. hotel occupancy reached 62.9% in October, which is down 8.8% from October 2019. U.S. revenue per available room in October was $84.75, down 7.6% from the same month in 2019. Average daily rate, however, was $134.78, a 1.2% increase over October 2019.

In a video presentation analyzing the monthly data, Jan Freitag, national director of hospitality analytics for CoStar Group, said hotel occupancy in the middle of the week rose above the 50% mark.

"ADR growth continued unabated and it is good to see that we even see signs of life in the midweek occupancies," Freitag said."Midweek occupancy in October stood at 57%. That of course is still a far cry from the weekend occupancy in October that was roughly 74%."

According to the latest monthly data from STR — CoStar Group's hospitality analytics firm — U.S. hotel occupancy reached 62.9% in October, which is down 8.8% from October 2019. U.S. revenue per available room in October was $84.75, down 7.6% from the same month in 2019. Average daily rate, however, was $134.78, a 1.2% increase over October 2019.

In a video presentation analyzing the monthly data, Jan Freitag, national director of hospitality analytics for CoStar Group, said hotel occupancy in the middle of the week rose above the 50% mark.

"ADR growth continued unabated and it is good to see that we even see signs of life in the midweek occupancies," Freitag said."Midweek occupancy in October stood at 57%. That of course is still a far cry from the weekend occupancy in October that was roughly 74%."

This month, STR released its latest U.S. hotel industry forecast for 2021 and 2022 at the NYU International Hospitality Industry Investment Conference. Freitag said the recovery of U.S. hotel industry average daily rate is keeping pace with the recovery of demand, which has not been the case after past downturns.

STR is CoStar's hospitality analytics firm.

The STR forecast, he noted, calls for U.S. hotel industry room demand and rates to reach pre-pandemic levels in late 2022.

"It is quite remarkable in this upturn that ADR and demand are recovering at the same pace," Freitag said. "In prior recoveries, room demand always recovered first and was then followed much later by room rates."

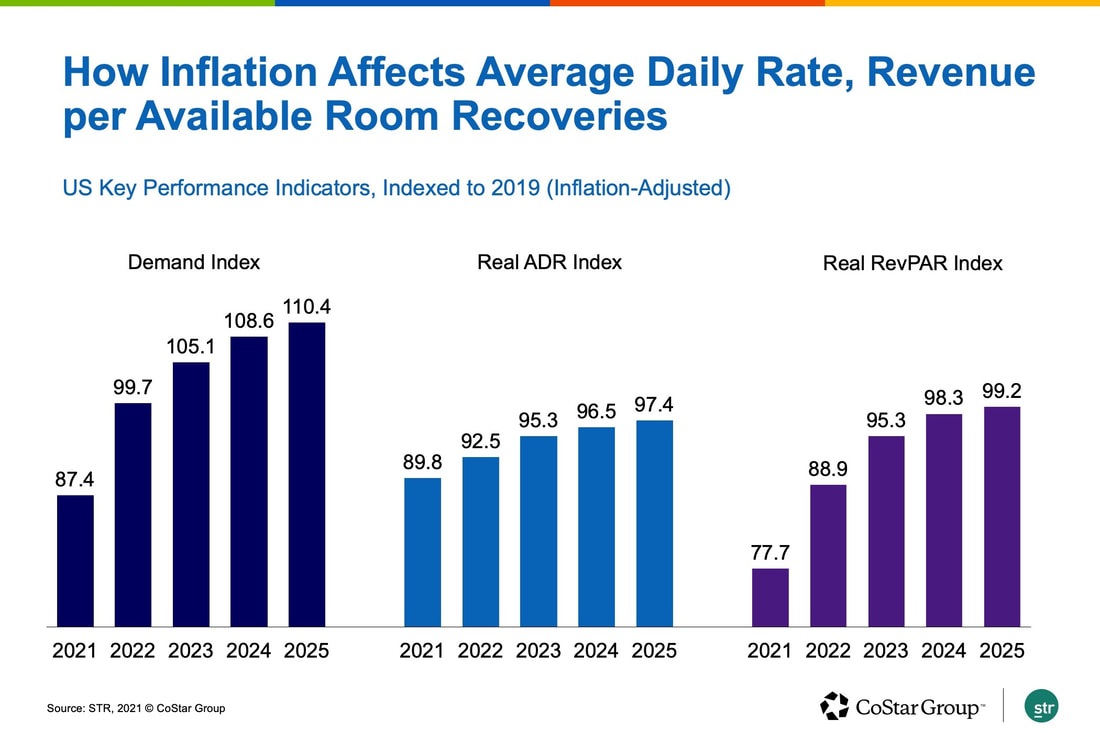

Adjusting for inflation, the road to recovery for the U.S. hotel industry doesn't have as many shortcuts, he said.

"Of course, room demand continues to hit 2019 levels in 2023 but [adjusting for inflation] room rates will not hit 2019 levels until much, much later — past 2025," Freitag said. "This then means that 2019 RevPAR levels [adjusting for inflation] will not be achieved until after 2025 either."

STR is CoStar's hospitality analytics firm.

The STR forecast, he noted, calls for U.S. hotel industry room demand and rates to reach pre-pandemic levels in late 2022.

"It is quite remarkable in this upturn that ADR and demand are recovering at the same pace," Freitag said. "In prior recoveries, room demand always recovered first and was then followed much later by room rates."

Adjusting for inflation, the road to recovery for the U.S. hotel industry doesn't have as many shortcuts, he said.

"Of course, room demand continues to hit 2019 levels in 2023 but [adjusting for inflation] room rates will not hit 2019 levels until much, much later — past 2025," Freitag said. "This then means that 2019 RevPAR levels [adjusting for inflation] will not be achieved until after 2025 either."

Still, the strength of leisure travel demand, coupled with the U.S. reopening to international travelers, means hoteliers will likely be able to keep rates high.

"The ongoing struggle that the hotel industry faces then is not so much about driving the top line but driving the bottom line," Freitag said. "We expect pricing power to persist with leisure travelers paying high rates, international travelers returning and high-end business travelers coming back to the downtown city centers."

"The ongoing struggle that the hotel industry faces then is not so much about driving the top line but driving the bottom line," Freitag said. "We expect pricing power to persist with leisure travelers paying high rates, international travelers returning and high-end business travelers coming back to the downtown city centers."