Egypt Leads North African Hotel Industry Recovery

Egypt Hotel Market Fully Open After Limiting Occupanc

With most COVID-19-related restrictions being lifted and international tourism flows having strongly recovered, the hospitality industry in Egypt is performing well above expectations and better than that of neighboring countries.

The United Nations World Tourism Organization estimated Egypt’s foreign tourist arrivals dropped by 72% in 2020 — from 13 million in 2019 to only 3.6 million in 2020.

In the first half of 2021, though, Egypt hosted 3.5 million tourists, and the preliminary data suggests stronger numbers for the second half.

"Generally, the rise in tourist flow can be explained by the ongoing pandemic situation in Europe. As lockdowns, as well as COVID-19 regulations, carry on in most countries, the temperatures are now starting to get lower in winter, and most Europeans would like to escape from the rather restricting life in their home countries to a pleasant vacation destination,” said Lars Pursche, general manager at Kempinski Soma Bay, near Safaga, Egypt.

The Egyptian hotel industry’s rebound has been spurred by the resumption in August of flights from Russia, which were suspended after the bombing of a Russian aircraft over the Sinai Peninsula in 2015 that killed all 224 people on board. Tourism has also been helped by Egypt’s removal from the United Kingdom’s red list in September, which led to increased flights from other European countries.

The United Nations World Tourism Organization estimated Egypt’s foreign tourist arrivals dropped by 72% in 2020 — from 13 million in 2019 to only 3.6 million in 2020.

In the first half of 2021, though, Egypt hosted 3.5 million tourists, and the preliminary data suggests stronger numbers for the second half.

"Generally, the rise in tourist flow can be explained by the ongoing pandemic situation in Europe. As lockdowns, as well as COVID-19 regulations, carry on in most countries, the temperatures are now starting to get lower in winter, and most Europeans would like to escape from the rather restricting life in their home countries to a pleasant vacation destination,” said Lars Pursche, general manager at Kempinski Soma Bay, near Safaga, Egypt.

The Egyptian hotel industry’s rebound has been spurred by the resumption in August of flights from Russia, which were suspended after the bombing of a Russian aircraft over the Sinai Peninsula in 2015 that killed all 224 people on board. Tourism has also been helped by Egypt’s removal from the United Kingdom’s red list in September, which led to increased flights from other European countries.

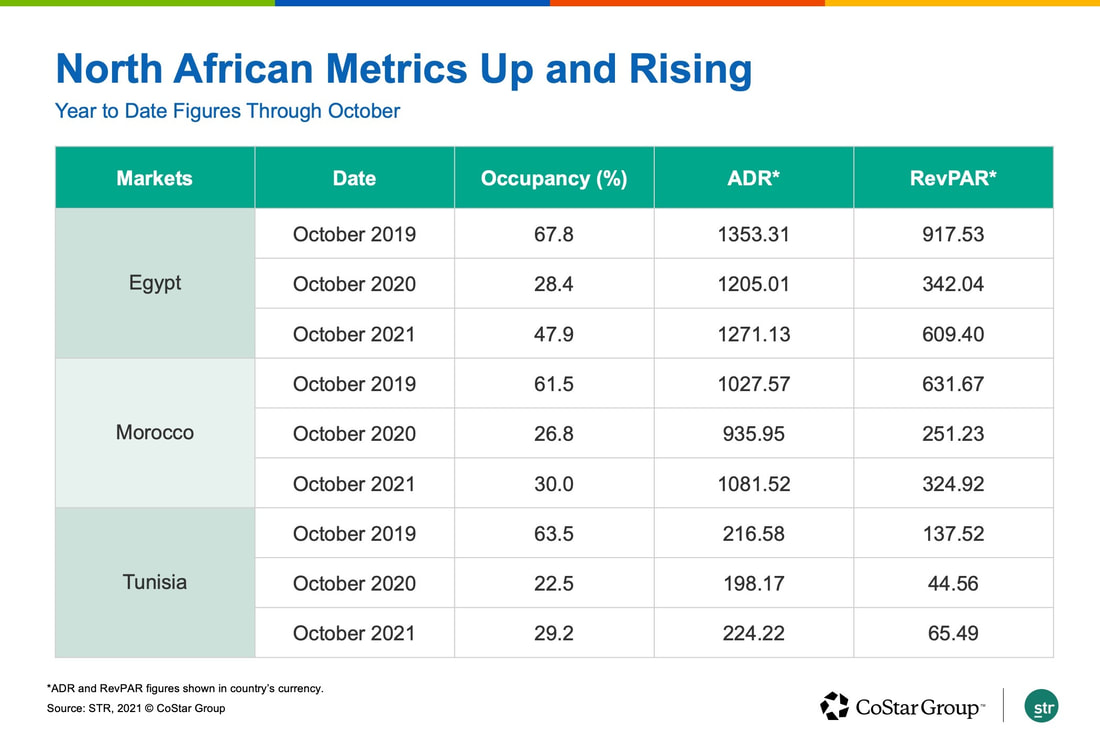

For the first 10 months of 2021, average occupancy in Egypt stood at 47.9%, compared to 28.4% during the same period of the previous year and 67.8% during the same period of 2019, according to data from STR, CoStar’s hotel analytics firm.

Average daily rate across the same period was 1,271.13 Egyptian pounds ($80.91), compared to 1,205.01 Egyptian pounds in 2020 and 1,353.31 Egyptian pounds in 2019, while revenue per available room for those three years was 609.40 Egyptian pounds, 342.04 Egyptian pounds and 917.53 Egyptian pounds, respectively.

STR data also shows occupancy in Tunisia rose to a year-to-date average of 29.2% over the first 10 months of 2021. Over the same period in 2020, occupancy averaged 22.5%, down from 62.5% in 2019. ADR in the market has climbed slightly, though, from 216.58 dinar in 2019 to 224.22 dinar in 2021.

Tunisia hotel RevPAR is down steeply from 2019’s average of 137.52 Tunisian dinar to 65.49 dinar for the first 10 months of this year.

“Our occupancy rate has improved tremendously since September but still not as it used to be in pre-coronavirus times,” said Leila Ben-Gacem, owner of capital Tunis’ Dar Ben-Gacem Hotel.

“I am optimistic for next year as there are many initiatives in the field of tourism diversification development," she said.

“There is better attention to small tourism lodging, but also booking windows are much smaller, stays are longer and guests are more willing to adventure in small local restaurants or public transportations,” she added.

Morocco’s hotel industry also has managed a slight recovery from last year’s slump, according to data from STR.

In the first 10 months of 2021, Morocco hotels averaged 30% occupancy, up from 26.8% over the same period of 2020 but still far below the 61.5% achieved in 2019. ADR for the same period was 1,081.52 Moroccan dirham ($117.15), compared to 1,027.57 Moroccan dirham in 2019, while RevPAR stood at 324.92 Moroccan dirham, up from 251.21 Moroccan dirham in 2020, but almost 50% lower than 2019’s figure of 631.67 Moroccan dirham.

Rachid Oubassou, cluster manager, sales and marketing, at Radisson Blu Marrakech, said “we felt a small recovery, not a full recovery. The COVID-19 virus has not disappeared. Today we know that the future can be better if the pandemic does not worsen.”

Phoenix Rising

The recovery of Egypt's hotel industry has been constrained by government orders to limit hotel occupancy first to 50% and then to 70%.

The recent withdrawal of that rule is expected to fuel further improvement in operational performance.

“With the recent lift of the occupation limitation previously set by the government, hotels in Egypt may now accommodate guests again up to their full capacity,” Pursche said.

Egyptian hoteliers are optimistic.

“We do expect a high demand over New Year's and a continuance of the previous seasonality trends that are typical for tourism in Egypt. Although there remains an uncertainty if foreign countries might close down for lockdown over the Christmas season, we are thinking positively and are looking forward to a successful year 2022,” Pursche added.

Noha Nabil, director of marketing and communications at Desert Rose Hotel in Hurghada, Egypt, said “once tour operators and charter flights were back, we can safely say demand and actual bookings were back to the pre-coronavirus level. Occupancy is back to normal.”

“Now we are allowed back to 100% [occupancy]. Since last winter, we are also back to normal tariff rates,” she said, adding expectations are bright.

“We are sold out with a versatile segmentation quota from our primary markets Russia, Germany, U.K., Ukraine, Romania and Belarus,” she said.

“A lot of flights are open, and we believe that within the last one and a half years of pandemic … people are able to better assess the formerly assumed risk of traveling. The epidemiological situation does remain unpredictable, but we believe the aforementioned state of mind might be the most relevant factor on why people started traveling again and are willing to spend more on their long-awaited vacation,” Pursche said.

Average daily rate across the same period was 1,271.13 Egyptian pounds ($80.91), compared to 1,205.01 Egyptian pounds in 2020 and 1,353.31 Egyptian pounds in 2019, while revenue per available room for those three years was 609.40 Egyptian pounds, 342.04 Egyptian pounds and 917.53 Egyptian pounds, respectively.

STR data also shows occupancy in Tunisia rose to a year-to-date average of 29.2% over the first 10 months of 2021. Over the same period in 2020, occupancy averaged 22.5%, down from 62.5% in 2019. ADR in the market has climbed slightly, though, from 216.58 dinar in 2019 to 224.22 dinar in 2021.

Tunisia hotel RevPAR is down steeply from 2019’s average of 137.52 Tunisian dinar to 65.49 dinar for the first 10 months of this year.

“Our occupancy rate has improved tremendously since September but still not as it used to be in pre-coronavirus times,” said Leila Ben-Gacem, owner of capital Tunis’ Dar Ben-Gacem Hotel.

“I am optimistic for next year as there are many initiatives in the field of tourism diversification development," she said.

“There is better attention to small tourism lodging, but also booking windows are much smaller, stays are longer and guests are more willing to adventure in small local restaurants or public transportations,” she added.

Morocco’s hotel industry also has managed a slight recovery from last year’s slump, according to data from STR.

In the first 10 months of 2021, Morocco hotels averaged 30% occupancy, up from 26.8% over the same period of 2020 but still far below the 61.5% achieved in 2019. ADR for the same period was 1,081.52 Moroccan dirham ($117.15), compared to 1,027.57 Moroccan dirham in 2019, while RevPAR stood at 324.92 Moroccan dirham, up from 251.21 Moroccan dirham in 2020, but almost 50% lower than 2019’s figure of 631.67 Moroccan dirham.

Rachid Oubassou, cluster manager, sales and marketing, at Radisson Blu Marrakech, said “we felt a small recovery, not a full recovery. The COVID-19 virus has not disappeared. Today we know that the future can be better if the pandemic does not worsen.”

Phoenix Rising

The recovery of Egypt's hotel industry has been constrained by government orders to limit hotel occupancy first to 50% and then to 70%.

The recent withdrawal of that rule is expected to fuel further improvement in operational performance.

“With the recent lift of the occupation limitation previously set by the government, hotels in Egypt may now accommodate guests again up to their full capacity,” Pursche said.

Egyptian hoteliers are optimistic.

“We do expect a high demand over New Year's and a continuance of the previous seasonality trends that are typical for tourism in Egypt. Although there remains an uncertainty if foreign countries might close down for lockdown over the Christmas season, we are thinking positively and are looking forward to a successful year 2022,” Pursche added.

Noha Nabil, director of marketing and communications at Desert Rose Hotel in Hurghada, Egypt, said “once tour operators and charter flights were back, we can safely say demand and actual bookings were back to the pre-coronavirus level. Occupancy is back to normal.”

“Now we are allowed back to 100% [occupancy]. Since last winter, we are also back to normal tariff rates,” she said, adding expectations are bright.

“We are sold out with a versatile segmentation quota from our primary markets Russia, Germany, U.K., Ukraine, Romania and Belarus,” she said.

“A lot of flights are open, and we believe that within the last one and a half years of pandemic … people are able to better assess the formerly assumed risk of traveling. The epidemiological situation does remain unpredictable, but we believe the aforementioned state of mind might be the most relevant factor on why people started traveling again and are willing to spend more on their long-awaited vacation,” Pursche said.